Enjoy an Easier Way to Pay. Every Day.

Make all your purchases easy and secure, in person and online, with a Gulf Coast Educators FCU Visa® Credit Card.

You can choose from our Classic, Rewards or Texas Educators Rewards Credit Card.

Choose the Card that Best Fits Your Needs

Classic Credit Card

✔ Rates as low as 11.24% APR*

Rewards Credit Card

✔ Rates as low as 12.24% APR*

✔ Earn 1 point for every $1 spent

TX Educators Rewards Credit Card

✔ Rates as low as 9.24% APR*

✔ Earn 1 point for every $1 spent

All GCEFCU Credit Cards Come With the Following Benefits

No Annual Fee or application fee

No Balance Transfer Fees on any debt you’d like to transfer to your new GCEFCU credit card

Tap To Pay feature available on all cards, making checkout quicker and more secure

0% Introductory APR* for your first 6 months, and a low variable rate after that

No Cash Advance Fees on cash advances done at any GCEFCU location

Apply Online and we’ll mail your card straight to you, or you can pick it up from any GCEFCU location

Click For Credit Card Features

Card FeaturesCard Features

Our cards are designed to make everyday banking easier, safer, and more convenient. With built in security features, easy payment options, and smart tools to help you stay on top of your spending, you get everything you need in one reliable card. Whether you’re shopping in store, online, or on the go, enjoy the confidence and flexibility that comes with a card made for your life.

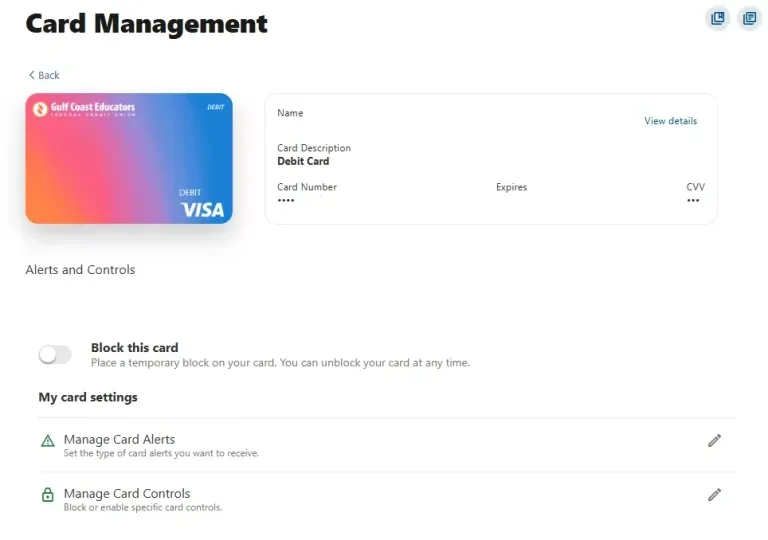

Digital IssuanceDigital Issuance® Credit Cards

To view your existing card information without having your physical card, click the “View Details” link in the Manage Cards widget of Online Banking or your Mobile App. Once your card has been digitally issued through this method, you can utilize it for digital purchases or manually add it to your mobile wallet without having the physical card present! Download our Mobile App today!

TravelingTraveling With Visa® Credit Cards

You can now easily put in a travel exemption through our Mobile App under the card management tab. Download our Mobile App, or if you have questions, you can call us at (281) 487-9333.

Lost or StolenLost or Stolen Credit Cards

If you’ve misplaced your credit card but believe it’s still nearby, you can place a temporary block on your card using the Manage Cards feature in Online Banking or the Mobile App. When you find your card, simply toggle it back on. If your card has been stolen, you can also report it directly through card management.

Rates and Disclosures

Credit Card Rates

| Card Type | Base APR* | APR* Range |

|---|---|---|

| Visa® Classic | 12.24% | 8.99% - 18.00% |

| Visa® Rewards | 13.24% | 9.99% - 18.00% |

| Texas Educators Rewards | 10.24% | 6.99% - 16.99% |

*APR = Annual Percentage Rate. Actual rates may vary based upon credit qualifications and are subject to change without prior notification. To view full credit card disclosures, click here.

Interest Rates and Interest Charges

Annual Percentage Rate (APR) for Purchases:

Visa® Classic: 8.99% – 18.00%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Visa® Rewards: 9.99% – 18.00%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Texas Educator Rewards: 6.99% – 16.99%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Annual Percentage Rate (APR) for Balance Transfers:

Visa® Classic: 8.99% – 18.00%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Visa® Rewards: 9.99% – 18.00%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Texas Educator Rewards: 6.99% – 16.99%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Annual Percentage Rate (APR) for Cash Advances:

Visa® Classic: 8.99% – 18.00%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Visa® Rewards: 9.99% – 18.00%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Texas Educator Rewards: 6.99% – 16.99%, when you open your account, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Penalty APR and When it Applies:

Visa® Classic: None

Visa® Rewards: None

Texas Educator Rewards: None

*APR=Annual Percentage Rate. Actual rates may vary based upon credit qualifications and are subject to change without prior notification.

Credit Card Fees

| Fee Type | Amount |

|---|---|

| Annual Fee | None |

| Account Set Up Fee | None |

| Program Fee | None |

| Participation Fee | None |

| Additional Card Fee | None |

| Application Fee | None |

| Balance Transfer | Free |

| Cash Transfer | $5.00 or 1.00% of the amount of each cash advance, whichever is greater. No fee if done in GCEFCU branch. |

| Foreign Transaction | 1.00% of each transaction in U.S. dollars. |

| Transaction Fee for Purchases | None |

| Late Payment | Up to $25 |

| Over the Credit Limit | None |

| Returned Payment Fee | Up to $25 |

Credit Card Details

How to Avoid Paying Interest on Purchases

Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month.

For Credit Card Tips from the Consumer Financial Protection Bureau

To learn more about factors to consider when applying for or using a credit card, visit the Consumer Financial Protection Bureau website by clicking here.

How We Will Calculate Your Balance

We use a method called “average daily balance (including new purchases).”

Effective Date

The information about the costs of the card described in this disclosure is accurate as of May 1, 2023. This information may have changed after that date. To find out what may have changed, contact Gulf Coast Educators Federal Credit Union.

To see full credit card disclosures, contact us.

Disclosures+ Show All | - Hide All

0% Introductory Rate *APR=Annual Percentage Rate

0% APR* on all new purchases to a new GCEFCU credit card for six months, beginning from the date of opening your card. After six months, your rate will convert to a variable APR* of 6.99% – 18.00% APR* based on your credit score. Actual rates may vary based upon credit qualifications and are subject to change without prior notification. This promotion is not valid for balance transfers or cash advances. This offer does not automatically approve you for a GCEFCU credit card. GCEFCU reserves the right to cancel this promotion at any time, for any reason.